The Chinese yuan is on a tear.

The currency hit a three-year high in offshore markets on Thursday while the U.S. dollar index hovered near 12-month lows, accentuating an ongoing divergence. China’s yuan has outperformed against the dollar since mid-2020.

Two traders flagged several ways to play the shifting currency market on CNBC’s “Trading Nation” on Thursday.

1. Emerging market bonds

The widely anticipated dollar weakness gives investors an opportunity to put money to work abroad, said Tocqueville Asset Management portfolio manager John Petrides.

He suggested playing the dollar-yuan divide via the VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC), a basket of emerging market bonds denominated in local currencies.

“You’re getting near a 5% yield and you’re investing in emerging market bonds because the world is less fearful about credit risks today than we were a year ago,” he said. “About 10% of this ETF is geared towards China, so, you do participate in this trade … and you pick up some yield in what’s been a stubbornly low-yield market.”

2. Copper

With the yuan now above a multiyear downtrend versus the dollar, China can use its currency’s strength to its advantage, said Bill Baruch, the founder and president of Blue Line Capital.

“Their currency is going to travel farther for them and allow them to buy more commodities,” he said in the same interview Thursday.

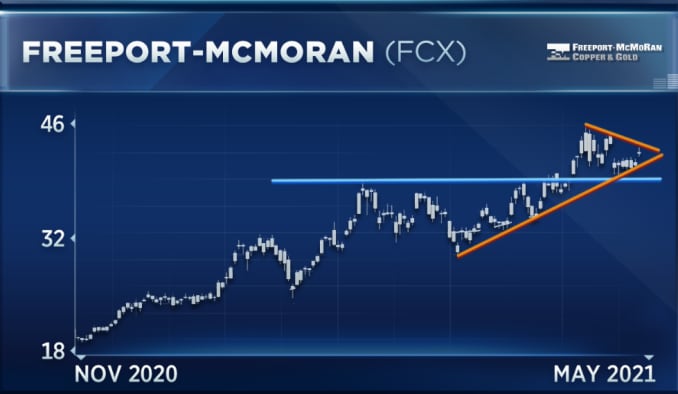

Baruch was especially partial to copper — he owns calls on the underlying commodity — and suggested playing it through mining company Freeport-McMoRan.

“You’ve got a nice little uptrend there wedging out,” he said. I think that could break out to the upside.”

3. Gold miners

Gold miners also look good on a technical basis, Baruch said, pointing to a flag pattern in the VanEck Vectors Gold Miners ETF (GDX) that chart analysts often interpret as a sign of more upside.

4. Energy

Baruch also liked energy stocks as a bet on the yuan’s strength.

He’s been invested in Chevron, Marathon Petroleum, Pioneer Natural Resources and various midstream companies for the last year, he wrote in an email to CNBC.

“China’s demand for energies is very well known,” he said in the interview Thursday. “I don’t think it’s going anywhere, although there’s times where it softens a little bit.”

5. Crude oil

Baruch sees crude oil prices headed higher, especially with Goldman Sachs calling for $80 a barrel. Prices edged higher to just under $67 on Thursday.

“I think crude oil is about to break out,” he said. “We’re at the tail end of a very seasonally bullish time here, so there’s upside in commodities in general.”

Disclosure: John Petrides and some Tocqueville Asset Management clients own shares of EMLC.

Disclaimer